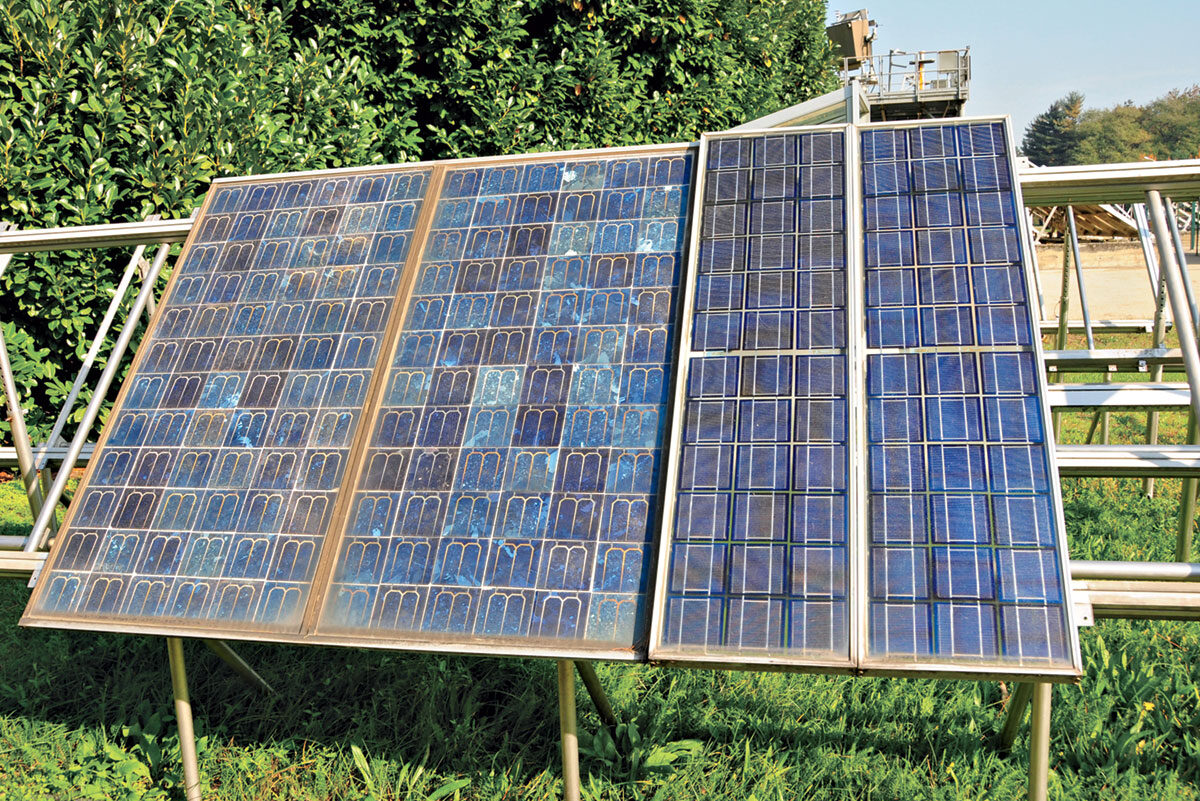

Of the available solar panel systems, the off-grid system is the most installed in the

Highlights

Introduction to Solar Energy through the Mystery Box Game

To kick off your lesson on solar energy, you’ll want to capture the students’ curiosity right from the start. A great way to do this is by incorporating a playful element known as the mystery box game. This game is not just for fun; it’s a strategic tool to pique interest and build anticipation for the topic of solar energy. Before the students even know what the day’s lesson will entail, present them with a selection of boxes, each containing an item related to solar energy. The catch is that they can’t see inside the box; they can only shake it and feel it from the outside. This initial engagement sets a tone of intrigue …

Pellet Heater vs Wood Heater – Which is the Best?

When it comes to selecting a heating system for your home, the choice between a pellet heater vs wood heater is one that homeowners often grapple with. Both options have their unique attributes and drawbacks. Hence, the decision is a matter of matching your specific heating needs and preferences to the characteristics of each type of stove. We’ll make a detailed comparison of wood and pellet stoves, focusing on efficiency, cost, maintenance, environmental impact, and overall user experience. Speaking of environmental impacts, you can also learn about portable generators and solar panels in these guides. So, whether you love the traditional appeal of a wood-burning stove or the modern convenience of a pellet stove, knowing …

How to Control a Solar Heating System for a Pool

There are two primary ways to control or regulate the solar heating system for a pool – manual and automatic. Both ways have their benefits and downsides. Solar technology has come a long way indeed. Since the quest for utilizing renewable energy began, a lot of innovations have taken place, and one of them is the solar pool heating system. Most homeowners that own a pool on their property, especially those in temperate or cold regions, can attest to the fact that on many occasions, their pool water becomes very chilly to swim or relax in. During the winter season, the pool even freezes. This is an issue the pool heating system solves. In this …

Why You Should Have Solar Pool Heating System in Texas

If you live in Texas, you are lucky enough to have an extended pool season. Still, as pool season comes to a close, it’s always a bit of a letdown. You can still use a solar pool heater to extend the pool season. Generally, a solar pool heater maximizes the advantages of natural sunshine, which means you can ultimately reap the benefits of natural sunlight shining on your premises. Pool water is routed via pipes to your solar arrays, which are warmed by solar radiation as it rises through it. Reasons Why You Should Invest in a Solar Pool Heater An Efficient and Affordable Pool Heating Solution Pool owners nowadays have access to a broad …

Portable Generator Usage Guide

Did you know that most carbon monoxide incidents happen because of improper use of generators? All generators have a labeled warning sticker that explains the risk of death should the generator be used inside a garage or a home. However, most people overlook this warning. Sadly, this ignorance has cost the lives of 400 people in the United States every year. To fully understand the threats generators pose and the safety precautions they should take to prevent the risks, users must read manuals before beginning operations. It would help if you never run a generator inside your home or in the garage. The generator should always be 20 feet or more away from any vents, …